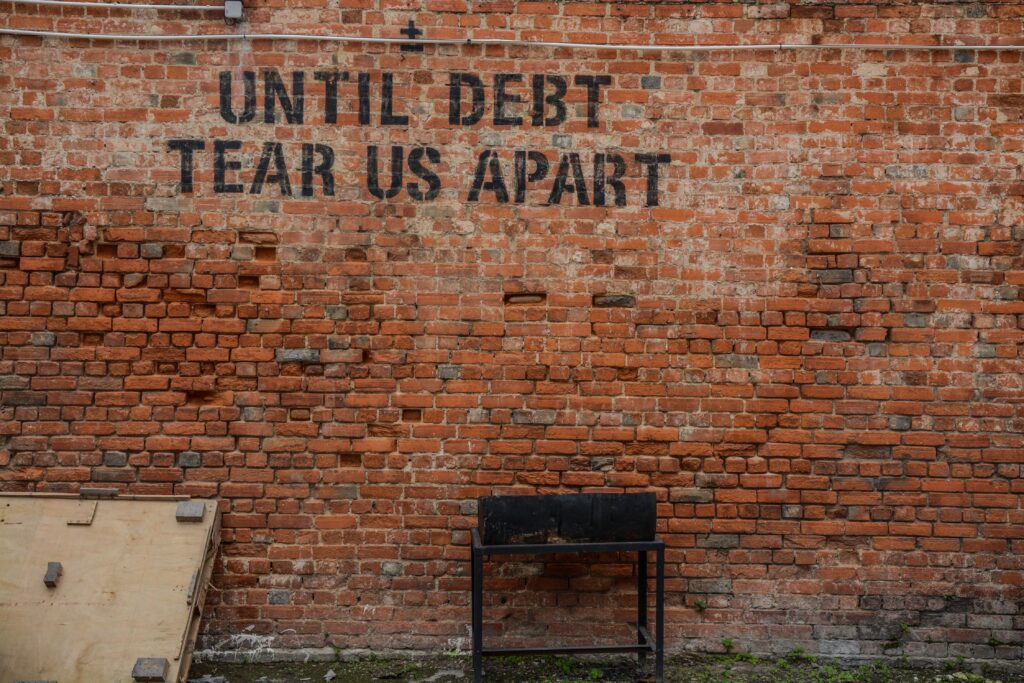

The UK is currently on the brink of recession and millions of households are experiencing a cost of living crisis. Recent survey evidence (JRF, 2022) indicates that more than one fifth of the UK population is now living in poverty. Financial difficulties often go hand-in-hand with mental health problems (Acton, 2016; O’Brien et al., 2014; Richardson et al. 2013; Ridley et al. 2020). Causal relationships can be complex and work in both directions: debt and money worries can contribute to mental distress, whilst mental health problems can lead to loss of income and difficulties managing finances (Acton, 2016; Have et al. 2021; Mackenzie and Holkar, 2016; Ridley et al. 2020).

The punitive social security system in the UK also causes financial instability and insecurity for many people living with mental health problems, as the Mental Elf has reported on previously: (Simpson, 2020; Hubbeling, 2021; Bell, 2020)

Regaining financial stability and a sense of control over finances can be an important step in improving mental health. The overarching aim of the research was to “develop a combined intervention between IAPT and Citizen’s Advice that can support clients with mental health and money worries together”.

The cost of living crisis is expected to impact mental health across the population. This study aimed to explore the possibility of a much-needed combined money and mental health service.

Methods

As a first stage in this research (reported in the current article), the researchers carried out semi-structured interviews with a purposively selected sample of IAPT (Improving Access to Psychological Therapies) service users (n=16), IAPT therapists/practitioners (n=14) and money advisors from Citizen’s Advice (n=6). The interviews gathered views and experiences of the different stakeholders on the benefits of a joined-up intervention and the effective design of such a service. Service users and IAPT staff were interviewed individually, whilst the Citizen’s Advice staff took place in a group discussion. All data collection was done online.

Interviews were recorded and transcribed, with summaries of the interviews returned to participants for member checking. Data were analysed by two of the authors, using a thematic analysis approach and supported by NVivo 12 software.

Results

The achieved sample represented a range of ethnicities among service users, therapists and advisers, although the service user sample was predominantly White. Females made up over half of the service user sample, and 100% of the staff sample were female.

The qualitative thematic analysis resulted in seven themes:

- Impact of money worries and mental health problems

- Benefits of a combined money advice and mental health intervention

- Components of money advice

- Introducing money advice into IAPT

- Format and delivery preferences for money advice

- Timing of the money advice

- Sharing information and collaboration between services.

Overall, there were many overlaps in thematic findings from the different stakeholder groups and a large degree of consensus about the key features of an effective service design. Points of agreement included: the overall value of a combined intervention to improve mental health; the importance of practical support, information and tools to manage money and maximise income; a preference for one-to-one and face-to-face delivery (although telephone was acceptable to some); and that services should be flexible and tailored, with money advice available both in tandem with mental health treatment but also extending over the longer term (i.e. beyond time-limited access to therapy). The sharing of at least minimal information between services was also endorsed in order to support more holistic and joined-up working.

Interestingly, some themes were raised by only one or two of the stakeholder groups. For example, only service users spoke in detail about the specific ways in which mental health and financial problems interact, whilst only the professional groups talked about the timing of introduction of services. There were also some discrepancies in perspective, for example, some staff (particularly IAPT practitioners) felt that money advice should be started before therapy, whilst others felt therapy should begin before money advice was initiated. Whether or not money advice should be proactively raised with all service users, or whether practitioners should wait for individual service users to spontaneously raise financial concerns, was another point where it seemed that views were not always aligned.

All stakeholders agreed that money advice should be given in tandem with mental health treatment, but also extend over the longer-term.

Conclusions

Overall, there was consensus among all three stakeholder groups that a combined money advice and mental health intervention would be both beneficial and feasible.

The authors concluded that:

a service that could combine support for both aspects, and which was flexible to clients’ needs, could help improve recovery in IAPT.

The next step for their research programme is to determine more specifically the feasibility and acceptability of such a combined intervention.

Service users, therapists and financial advisers all agreed that a combined money and mental health intervention was necessary and would prove effective.

Strengths and limitations

This is an important and helpful piece of research. The inclusion of multiple stakeholder perspectives is a key strength of the study, and sample sizes are appropriate for its aims and scope. The lack of males in the staff sample is notable, although is perhaps a reflection of the wider workforce of IAPT and welfare advice practitioners. Future research would benefit from greater ethnic diversity among service user perspectives, particularly in light of known inequalities around race, poverty and mental health (Bignall et al., 2019; Matejic & Earwaker, 2022).

Whilst the issue of associations between mental health and financial difficulties is arguably universal, the focus of this study is quite specific – relating to a mental health service model still essentially unique to England and to a well-established UK-based advice service. Findings may well be insightful for other country contexts, but the localised geographical/policy context of this study should be borne in mind when considering the transferability of implementation implications.

As a researcher whose interests extend to the theoretical conceptualisation of mental health (alongside the policy and practice of mental health support), one question that circulated as I read the paper was the sense of separation of ‘mental health problems’ from financial worries. It was noteworthy that IAPT practitioners did not see discussion of services users’ financial worries as being part of their remit; rather, it was seen as a time-consuming disruption to treatment. In the framing of the paper overall, there was also some sense that a mental health problem was positioned as a standalone entity that was influenced by money worries, rather than a more integrated conceptualisation of financial worries being part-and-parcel of the manifestations of mental distress. This is a complex proposition and one that I am still grappling with in my own work. It is not a fundamental critique of the paper – which makes a valuable and practical contribution to thinking around service design. However, in the broader sphere, I am curious about how social struggles and social suffering (including financial difficulties) themselves constitute what we have come to refer to as mental health problems in contemporary discourse.

Is it really possible to separate mental health problems from financial worries?

Implications for practice

As the authors argue, support to address financial difficulties could in turn improve recovery rates within mental health services (see also Acton, 2016). Co-locating mental health and financial advice services would make such support easier to access for service users and contribute to more timely and streamlined intervention. Previous research also supports the value of co-locating welfare advice in health services (e.g. Robotham et al., 2019, Woodhead et al., 2018, Evans, 2018).

The cost of living crisis that is intensifying as I write will only increase people’s vulnerability to financial strain and risk of related mental health difficulties. Accessible provision of expert financial advice will be crucial for people who are struggling to make ends meet, as recession bites and ongoing reforms to the UK welfare system show little sign of easing people’s financial burden. A combined service as outlined by Belcher et al’s study would certainly be of value to service users, and potentially improve the capacity of IAPT practitioners to deliver treatment interventions effectively.

However, in any pilot initiative that follows this research, it will be essential to consider the implications for practitioners in terms of role boundaries and capacities. IAPT practitioners already work to strict protocols and time parameters; introducing new elements to their information-giving role needs to be sensitively considered, and staff need to be equipped with relevant information and expertise before being given new duties. Joining up a coordinated service across public and third sector bodies will also entail careful consideration around the management and allocation of the required financial resources.

Co-locating mental health and financial advice services would make such support easier to access for service users and contribute to more timely and streamlined intervention.

Statement of interests

I have a professional acquaintance with two of the authors of this study and we have had informal discussions in the recent past about topics around mental health, welfare benefits and financial difficulties. I have never worked directly with the authors on research projects, but I have worked on (unconnected) research about IAPT services.

Links

Primary paper

Belcher HL, Evans J, Bond N et al (2022) Views of services users and staff on a combined money advice and psychological therapy service within IAPT. Journal of mental health, 1–9. Advance online publication.

Other references

Acton, R. (2016). The Missing Link.

Bell, A. Social security? Evidence about benefits and mental health. The Mental Elf, November 2020.

Bignall T. Jeraj S, Helsby E, Butt J (2019) Racial disparities in mental health: Literature and evidence review.

Evans, K. Does co-locating welfare advice services improve mental health? The Mental Elf, March 2018.

Have MT, Tuithof M, Van Dorsselaer S et al. (2021). The Bidirectional Relationship Between Debts and Common Mental Disorders: Results of a longitudinal Population-Based Study. Administration and Policy in Mental Health, 48(5), 810–820.

Hubbeling, D. Mental health and benefits insecurity. The Mental Elf, October 2020.

Mackenzie P and Holkar M (2016). Money on your Mind (PDF). Money and Mental Health Policy Institute. 2016.

Matejic P and Earwaker R (2022) Ethnicity and the heightened risk of very deep poverty.

O’Brien C, Willoughby T, Levy, R. (2014) The Money Advice Service Debt Advice Review 2013/14.

Richardson T, Elliott P, Roberts R (2013) The relationship between personal unsecured debt and mental and physical health: a systematic review and meta-analysis. Clinical psychology review, 33(8), 1148–1162.

Ridley M et al. (2020) Poverty, depression, and anxiety: Causal evidence and mechanisms. Science 370, eaay0214 (2020).

Robotham, D., Andleeb, H., Couperthwaite, L., & Evans, L. (2019). Evaluation of the Mental Health and Money Advice Service.

Simpson, A. Universal Credit increases mental health problems, but not employment. The Mental Elf, May 2020.

Woodhead, C., Khondoker, M., Lomas, R. and Raine, R. (2017) “Impact of co-located welfare advice in healthcare settings: prospective quasi-experimental controlled study,” British Journal of Psychiatry. Cambridge University Press, 211(6), pp. 388–395.